Retail’s biggest question is no longer “Do I need to change?” but “How much can I do, and how fast?” and the clock is ticking on retailers grasping onto the status quo.

Success in this new era of shopper-led retail requires taking the best practices of digital and physical retail and delivering a seamless, branded shopping experience that connects with customers, on their terms. We are certainly in the midst of a revolution but does this mean legacy retail is dead? Will “digital natives” be the only retailers who thrive? Can anyone compete with Amazon?

Of course, the answers aren’t so simple, and as with everything in retail, there is no one size fits all. In this complicated age of changing realities, there are winners and losers on both sides of the aisle, so to speak. There are digital natives who will open a lot of stores and will do very well. And, there are legacy retailers who will find some special combination of their heritage and a new digital-first mentality, and will find themselves standing out from the pack.

For the past ten years, RetailNext has been working with retailers to navigate this changing landscape – and what change we have seen! Record bankruptcies, store closures and realignments and an equal amount of innovation finding its way into the physical world have all made their mark, and I believe we will not recognize today’s retail in ten years’ time. We are currently seeing mass disruption across all sectors and it seems we are just getting started.

In my mind, there are five big trends guiding today’s retail revolution and shaping retail’s next frontier. Some of these are becoming standard operating procedure, some ae evolving and some are just getting started. But my opinion is that these will shape commerce and will leave us with happier customers in the years to come.

Trend 1: Bricks to Clicks

There is no doubt the past couple of years have been exceptionally brutal for large-scale legacy retailers. Bankruptcies and store fleet rationalization stories have dominated the headlines, and Wall Street has been brutally punishing the retailers who have not communicated and illustrated a clear path to the future. There have been exceptions, of course. Brands like Sephora and Ulta, with their focus on experience, have stood out, as have the retailers that are less susceptible to the disruption of Amazon – retailers like Home Depot and Lowe’s.

So what gives? Is it a retail apocalypse or a retail renaissance? I’d say it’s something in between.

We have long held the belief that today’s retailer looking to compete on price alone will not win. With the notable exception of Walmart, it is near impossible to beat Amazon in either convenience or price, and while the jury is still out on Walmart’s ability to do so, with the acquisitions of Jet, Bonobos and others, they do actually stand a chance. If you think about the distribution network of Walmart, it’s not a stretch to think about same day or next hour delivery from one of their stores. And, price is something Walmart knows all too well.

Apart from distribution, there are three additional ways I believe legacy retail, meaning retailers who have large store fleets, can compete in today’s retail war.

The first is the ability to leverage physical stores to build better customer experiences. There are a couple of key categories where this is happening today – beauty and athletic. If you think about what Sephora has done with their Beauty Insider Program or what Nike has done with Nike Training Club, both are authentic ways to connect with consumers and in both cases there is something “in it” for consumers.

The second is the ability to leverage the large amount of data these retailers have about their customers. No new brand can come close to the consumer data that is available to legacy retailers – whether through their POS systems, loyalty programs or other clienteling applications, this data is gold, and from where I sit it is one of the least valued assets of retailers as they work to navigate today’s complex reality. One of the trends I am most excited about is what I call “back to life retailers.” Brands that have filed Chapter 11 and liquidated are being picked up by private equity companies and relaunched with technology, a clean real-estate slate and the best of both worlds – huge customer databases without bloated store networks. I expect to see more of this trend as we move forward (and hope that Toys R Us becomes one of the back-from-the-dead retailers).

The third, simply, is experience wins. It should not be underestimated how complicated it is to manage a network of hundreds (or thousands) of stores that stretch around the globe. This is one area legacy retailers definitely have the advantage. For example, understanding payroll and tax differences from state to state and country to country is certainly something that can be learned, but when you layer this onto the other business priorities, for many new to brick-and-mortar retailers, it often falls to the bottom of the list. Additionally, while there has been a lot of progress made in understanding inventory movement and location-by-location planning, having the right product in the right store at the right time is still as much an art as it is a science. Legacy physical retailers understand this and have the depth and breadth of experience to manage these complexities. Digital natives are just getting started.

Trend 2: Clicks to Bricks, v1.0

Warby Parker and Bonobos are synonymous with digitally native retailers going physical. With successful online businesses, both companies hit a wall around customer acquisition and brand awareness. Customer acquisition became very expensive and eventually both companies (and many others, too) realized the best way to acquire new customers was, in fact, with physical stores. The same year legendary investor Marc Andreessen declared that “retail stores will completely die,” Warby Parker opened its first store. Then Bonobos followed suit. Then Rent-the-Runway. It is now clear that Andreessen was simply wrong. RetailNext, on the other hand, has long held the belief that the best marketing money a retailer can invest is in opening a store. Given the right product in the right location, the opportunity to build awareness and loyal fans is almost unlimited. And, with average specialty retail conversion rates hovering in the 20 percent range, there is a lot of opportunity to convert the rest. We believe there are hundreds of digitally native retailers who are ready for physical stores, and last year the NRF published research showing a net increase in store openings, and emphasized the point with the following excerpt:

Nonetheless, we keep hearing about record-level store closings and how this portends doom for the retail industry. But we’ve consistently argued that this data is drawn from a biased sample. IHL Group just published a report that offers a thorough and complete debunking of the main false premise supporting the retail apocalypse myth. Their data shows a net increase in store openings of over 4,000 in 2017. In fact, for each company closing a store, 2.7 companies are opening stores.

Currently the clicks to bricks brands represent the best in retail innovation. Brands like Allbirds, Casper, and UNTUCKit continue to lead the pack with store growth. And, of course, these brands are rewriting the store playbook along the way. It is clear that data is king, and for these retailers the expectation for what they know about their stores is very different than the legacy retailers we discussed before. These retailers want to know everything that happens in the store, and they continuously test and optimize against the data – truly bringing e-commerce-style analytics to physical stores in a way that has never been possible before.

These retailers are also leading the way in terms of how retailers have to build internal teams – data scientists have replaced merchants as kings or queens, and everyone pays attention to the data. As the role of the store continues to evolve, the metrics that matter will also continue to change. Whereas year-over-year same stores sales and sales per square foot once drove decision making across retail, today retailers are starting to think differently about metrics and are exploring ways to optimize lifetime value of customers, understand multi-channel touch points, and drive the value of the store in the multi-channel experience. Legacy retailers are taking notice, and many of these trends are being felt across all of retail.

Trend 3: Clicks to Bricks, v2.0

To date, the digital retailers turning physical have largely been in categories that are fairly straightforward. Lots of fashion and footwear, a ton of beauty brands, and to date, there are at least five online lingerie brands that are probably ready for their own stores. This model (and the 500 or so brands that have embraced it) is fairly well established at this point, and it makes a lot of sense – validate the brand, collect a ton of data and build stores where and when customers demand them. Continuous optimization with data and artificial intelligence is, of course, a given, and these stores continue to thrive.

I believe, however, that we will see even more innovation in this space. We know the role of the store is changing, and that any successful concept needs to keep experience as a key value, but I don’t think we even have a clue as to the magnitude of the change. This new model for retail is just getting started, and in the next generation I imagine we will see new format malls (or multi-brand retailers), new format DIY stores, and certainly new formats in grocery, drug and mass. These categories, while significantly disrupted by Amazon, are thus far largely unchanged in the physical stores. It is easy enough to imagine consumers getting involved even before the brand launches to help drive the product itself. This is happening in small ways today with niche brands like Shred Dog (www.shreddog.com), which has allowed parents to weigh in on children’s performance snow gear products before they even make it to the digital storefront. Expect this trend to evolve in big ways in the years to come.

Trend 4: Next Generation Direct-to-Consumer

We’ve covered the legacy retailers and we’ve covered the digital natives. But both of these retail formats are pretty much business as usual in some ways. They both use a storefront of some kind – either digital or physical – to get customers connected to products and both have a really important place to play in today’s retail landscape. But, what about the companies that are thinking about connecting products to people in a completely new way? To me, this is where some of the most exciting innovation in retail is happening.

Companies like Ron Johnson’s start-up, Enjoy, brings the retail experience into your home – or wherever you are – and eliminates a ton of friction in the IoT buying and installation process. San Francisco-based startup Dirty Lemon lets you buy premium wellness drinks via text for at-home delivery – quirky and niche, sure, but an interesting preview into text-commerce. Macy’s and Brookstone have recently launched services that build on the concepts pioneered by b8ta, where new brands are given a platform to sell in their real estate without having to invest in their own store fleets, at least to start. There are also the endless list of businesses that are trying to get meals delivered straight to your front door – through meal preparation services like Blue Apron or Freshly, grocery delivery services like Instacart or Amazon Fresh, big box disruptors like Boxed or niche services like ButcherBox (a subscription service for premium meat delivery). Each of these represents innovative approaches, some of which will ultimately fail but all of which will change the way we think about distribution in this category. The thing that all of these concepts, services, products and experiences have in common is an exceptional ability to collect and utilize data to deliver a better experience, and the ones that do this the best will ultimately prevail.

Trend 5: The Weird and the Wonderful

Okay … this is where things get interesting. What will the future of retail be? As I’ve mentioned before, I am not sure anyone knows. However, we do know that it will be weird and it should be wonderful. There will undoubtedly be a slew of companies who build virtual reality (VR) or augmented reality (AR) retail applications. There will be repurposed mall space, some of which will lend itself to interesting concepts. For example, it used to be that underserved communities in rural America would be the last to know about the latest fashion, or to experience new brands. I can imagine a time in the future where C- or D-tier malls are repurposed as inventory-free retail lifestyle centers where you can experience travel, shopping and entertainment in a way that has never been possible. And of course, there will be store concepts that continue to blend experience with commerce in ways that have never been tested before. Loyalty will become increasingly valuable and retailers and brands will blur the lines between experience, content and commerce in an effort to stay close to their most valuable assets – their customers.

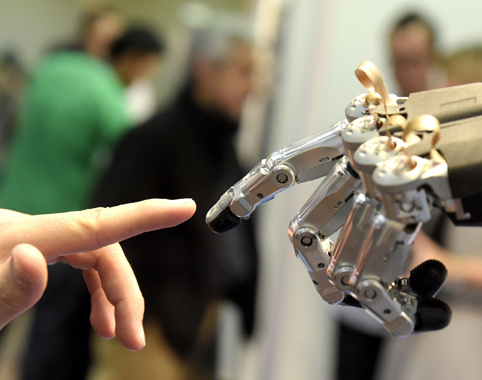

There will also be all kinds of new products that innovators need to find a distribution channel for. The consumer IoT space is growing by leaps and bounds and will lead to all sorts of connected experiences, which ultimately will find their way into retail concepts. There will also be a continued trend of upcycled retail, rental retail, retail transparency, and various other innovations and iterations. And while buzzwords like artificial intelligence and predictive analytics will certainly drive much of the innovation, the thing that will be at the center of this revolution will be the shopper, and rightly so. Today’s consumer continues to outpace retail with their expectations, knowledge and use of technology. If retailers get even close to meeting those expectations, the wonderful will outpace the weird and finally the shoppers will get what they demand.

Navigating the Revolution

The pace of change has already quickened in 2018. We see more retailers asking harder questions as they seek to drive a differentiated experience for the shoppers they are lucky to call customers and the ones they seek to acquire. The question is no longer “Do I need to change?” but “How much can I do, and how fast?” The clock is ticking on the status quo, and retailers who do not innovative will certainly die. On one hand, we expect more high profile bankruptcies and store closings this year, and on the other hand, we know there will be more than a few innovative retail ideas coming to life. The big questions to think about as you enjoy all of the delights Sonoma has to offer is “Are you moving fast enough?” and “Will you be part of the revolution or a casualty of it?”